Dilution

Dilution is a critical concern for business owners. In essence, dilution refers to the reduction in ownership stake experienced by an investor as a result of subsequent investment rounds or changes in the company’s equity structure. During investment rounds, equity holders may opt to relinquish a portion of their ownership stake in exchange for new capital to facilitate the growth of the company. Consequently, any business founder in need of external funds (other than debt) will inevitably face dilution at some point. For the investment deal to be profitable, the reduction in ownership must be offset by an increase in the remaining equity that is at least proportionate to the dilution experienced.

To illustrate how dilution works, consider the following example of a multiple round investment process. The accompanying spreadsheet summarizes the key details:

Seed Round

The startup was established with 1.5 million shares at a nominal estimated value of 1 Swiss franc, with 100% ownership held by the founder. The founder secured an investor, Investor 1, who was willing to inject 500,000 CHF during the seed round.

Both parties agreed on a pre-money valuation of 1,500,000 CHF, resulting in a post-money valuation of 2,000,000 CHF, which is calculated by adding the new capital to the pre-money valuation.

Investor 1’s ownership percentage is calculated as the additional capital divided by the post-money valuation, which amounts to 25% ownership and results in the founder’s dilution.

Founder: 75% // Investor 1: 25%

Although it may appear that the founder underwent dilution without any value added, in reality, two important things occurred during this stage. Firstly, the founder received market validation for the company’s potential value as Investor 1 validated this belief by investing at the agreed pricing. This validation increases the company’s liquidity by setting a price precedent. Secondly, the founder now has assets available to enhance the total value of the company and of the 75% ownership that was retained to counterbalance the initial dilution.

Series A

One year later, the company required additional funds of 2’000’000CHF to further expand its operations and initiated a Series A funding round. With the company’s significant accomplishments in the past year, it is now possible to forecast higher profitability or increase the chances of meeting the forecasted values. This, in turn, resulted in a pre-money valuation of 4’000’000CHF, which Investor 2 agreed to invest in. As a result, the post-money valuation increased to 6’000’000CHF. Using the same formula as before, the new ownership is split as follows:

Founder: 50% // Investor 1: 17% // Investor 2: 33%

At this point, the founder’s share is worth 3’000’000CHF, or 50% of the post-money valuation of 6’000’000CHF. Although the founder’s ownership was diluted by 50%, the company’s value has increased by four times, thus doubling the value of the founder’s initial holdings.

In contrast, Investor 1’s share decreased by one-third (1-17%/25%) due to the dilution, even though the company’s value increased by a factor of three (from 2M to 6M post-money). As a result, Investor 1’s total value increased by a factor of two (3*2/3).

Exit

The company has reached maturity and is now deemed ready for an exit, as the production and market risks have been mitigated. The company’s value has been adjusted with an exit multiplier of 5x on the latest post-money valuation of 6mCHF, resulting in a total valuation of 30’000’000CHF. A private investor has agreed to pay the full amount for the start-up, which will be distributed according to the ownership percentages computed at the end of the Series A round:

Founder: 50% // Investor 1: 17% // Investor 2: 33%

This amounts to 15’000’000CHF for the Owner, 5’000’000CHF for Investor 1, and 10’000’000CHF for Investor 2.

Although the founder holds only 50% of the initial equity, this still represents a 10x multiple on the initial absolute value of 1’500’000CHF. The founder captures half of the 20x increase in value acquired by the company since its inception.

Investor 1 captures 2/3 of the 15x increase in value since its initial investment, resulting in a 10x value increase from 500’000CHF to 5’000’000CHF.

Investor 2, having suffered no dilution, and with the company’s value having increased by a factor of 5x, sees their initial investment multiplied by 5x.

Net Multiplier explained

The net multiplier can be computed as the total return on investment relative to the degree of dilution.

Net multiplier = (1-dilution)*Multiplier

The net multiplier helps to understand the net profitability of a multi-round investment journey. For many investors, dilution is a great concern as it seems that the share of the cake is shrinking but the amount of food it represents must be put in perspective with the increase in the cake’s size. As long as the increase in the cake’s size is higher than the dilution, the investment remains profitable. This ratio is computed using the net multiplier.

In our previous example, the total value of the company increased by a factor 20x from 1.5mCHF to 30mCHF. Yet, the owner only increased its value by a factor 10x. Using the formula above we compute that:

Net multiplier = (1-50%)*20 = 10

Investor 1 experienced a one third dilution through the process while the company’s value increased by a factor 15x showing:

Net multiplier = (1-33%)*15 = 10

Finally, Investor 2 suffered no dilution while the value of the company was multiplied by 5x thus:

Net multiplier = (1-0%)*5 = 5

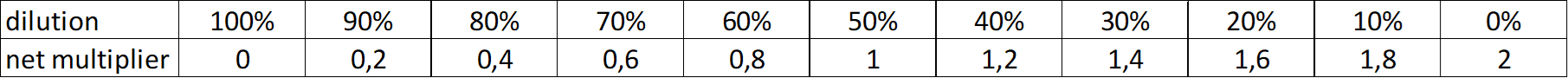

An investor’s goal is to maximize its net multiplier by finding the right balance between dilution and the increase in value of the company. A net multiplier of 1 implies that for 1mCHF invested, you end up with 1mCHF so no value was added in the process. A net multiplier lower than 1 implies a loss. Here is an example of an extreme scenario:

In this example we assume that the company’s value increases only by a factor 2x through the different rounds. This could happen for example if the seed round had a 4x multiplier (6mCHF) and due to severe production issues, the company has to divide by two its price in series A (3mCHF) to raise money to fix the issue. In this scenario, looking at the net multiplier distribution table, we observe that if the owner suffers a dilution greater than 50%, the amount he cashes out is lower than its initial investment. He must keep at least more than 50% equity to make a return on its initial investment.

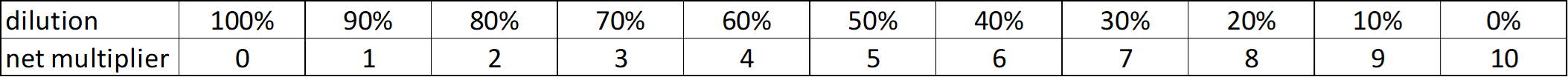

This scenario is rather unusual in a successful start-up which should see its value increased by a large factor through the rounds. Imagining a 10x increase in value, the net multiplier table shows:

As we can see, is the value of the company is multiplied by a 10x factor, the owner will have negative return only if its dilution is higher than 90%.

Keep in mind that Private Equity (PE) deals can have very complicated deal structures. Stock options, preferred rights, options and selling clauses can be implemented in the contract potentially resulting in strong dilution. For this reason, PE deals should be reviewed with a lawyer or a professional.