Valuation Methods

Valuing an early-stage start-up requires a nuanced approach, as different valuation methods may yield varying results. To ensure the accuracy and consistency of valuations, it is advisable to employ a combination of methods and assess the validity of assumptions made. Common methods used for start-up valuation include:

- DCF Valuation

- EBITDA multiplier

- Risk mitigation method

- Scorecard Valuation method

In the subsequent section, we will examine these approaches in detail, highlighting their respective advantages and limitations.

DCF Method

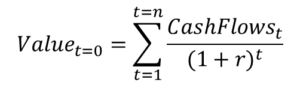

A discounted cash flow model (DCF model) is a financial model used to estimate a company’s intrinsic value by forecasting its future cash flows and discounting them to arrive at a Net Present Value (NPV). Unlike market-based valuation methods, such as comparable company analysis, the DCF model is based on the company’s ability to generate cash flows in the future for its shareholders, rather than arbitrary supply and demand for the company’s stock.

The DCF model requires the forecasting of a company’s cash flows into the future and discounting them to the present to arrive at a present value, which represents the company’s value. This formula is expressed as the present value equals the sum of future cash flows divided by one plus the discount rate raised to the power of the period, where the discount rate is denoted as ‘r’. The DCF model is often compared to the company’s market value to assess the company’s performance.

In practice, utilizing the aforementioned formula would necessitate the simulation of all cashflows perpetually. However, most DCF analyses employ a five-year forecast of cashflows, followed by the application of a terminal value formula to determine the residual value in perpetuity. Subsequently, the modified formula is as follows:

![]()

PROs and CONs

The DCF valuation method is a valuable tool for estimating the value of a company as it utilizes a bottom-up approach, in contrast to most top-down estimation methods. This approach is often favored by investors as it provides clear data on the assumptions, their combination (the business model structure), and their impact on the final valuation. Furthermore, the DCF valuation is an effective tool for sustaining conversations with investors, as assumptions can be adjusted in real-time and their impact on the final valuation can be analyzed.

However, the DCF valuation method also has some drawbacks, such as:

Limited suitability for start-ups

The DCF valuation method is best suited for developed companies with stable growth. As the cash flow of a start-up is too unpredictable to assume linear growth, the DCF valuation incorporates part of this inconsistency into the valuation.

No risk adjustment for assumption uncertainty

The DCF method requires static assumptions, which may provide a false sense of certainty. Risk adjustment factors and weightings can be added to the simulation to compensate for this uncertainty.

EBITDA Multiplier Method

The EBITDA multiple is a financial metric that evaluates a company’s Enterprise Value (EV) against its annual EBITDA, either historical or projected. This ratio is widely employed to ascertain the worth of a company and to compare it to similar businesses.

By leveraging the EBITDA multiple, variations in capital structure, taxation, fixed assets, and operational discrepancies across diverse companies can be normalized. Specifically, this metric computes the enterprise value, which encompasses market capitalization and net debt, and then compares it to the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) over a specific period.

EBITDA Multiple = Enterprise Value / EBITDA

By backward engineering this formula we can find the unknown EV:

Enterprise Value = EBITDA Multiple * EBITDA

PROs and CONs

The EBITDA valuation is a useful tool as it enables leveraging a pre-existing due diligence conducted for another company and applying the same valuation methodology to one’s own start-up. This approach is efficient in terms of time and resources and allows for easy communication of the underlying rationale to potential investors, who may view the success of a comparable company as an indicator of the potential for growth and fundraising success for the start-up in question. Industry-specific EBITDA averages are readily accessible online, as demonstrated by the following example:

On the other hand, this method presents several limitations. The primary challenge is finding a company that has a structure identical to the one being evaluated. Even minor changes in the business model or profit and loss (P&L) structure can result in errors in the valuation. Moreover, as start-ups are privately held and have no obligation to disclose their financial data, it can be difficult to obtain reliable information for comparison. While the EBITDA method can be used to complement a DCF valuation, it is inadequate on its own for producing a reliable valuation.

Scorecard Valuation Method

The Scorecard Method is another option for pre-revenue businesses. It also works by comparing your startup to others that are already funded but with added criteria.

First, you find the average pre-money valuation of comparable companies. Then, you’ll consider how your business stacks up according to the following qualities.

- Strength of the team: 0-30%

- Size of the opportunity: 0-30%

- Product or service: 0-20%

- Competitive environment: 0-10%

- Marketing, sales channels, and partnerships: 0-10%

- Need for additional investment: 0-10%

You’ll then assign each quality a comparison percentage. Essentially, you can be on par (100%), below average (<100%), or above average (>100%) for each quality compared to your competitors. For example, you give your ecommerce team a 150% score because it’s complete, fully trained, and has experienced developers and marketers, some from rival businesses. You’d multiply 30% by 150% to get a factor of .45.

Do this for each startup quality and find the sum of all factors. Finally, multiply that sum by the average valuation in your business sector to get your pre-revenue valuation.

PROs and CONs

As for the EBITDA Valuation, this method relies on comparable companies. The advantage again is that it is easy to produce and quite intuitive to pitch. On the other hand, it suffers from the same average and comparability flaws as for EBITDA multiplier. Therefore, it should also be used as an additional way to sustain the DCF Valuation but is to light to be used as a valuation alone.

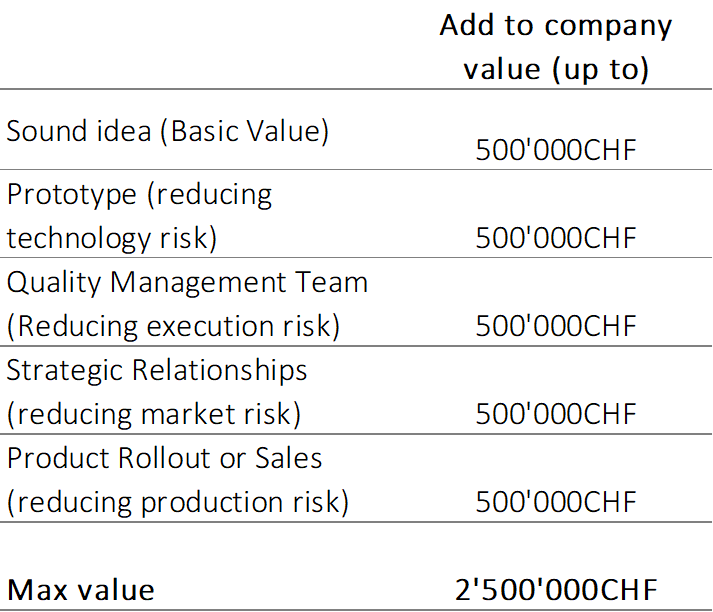

The Berkus or Risk mitigation Method

The Berkus Method was created by venture capitalist Dave Berkus to find valuations specifically for pre-revenue start-ups, i.e., businesses not yet selling their products at scale. The idea is to assign dollar amounts to five key success metrics found in early-stage start-ups. The idea behind is very similar to the Scorecard method. If the average company value at seed stage in your industry is 2.5m, split this amount into the 5 milestones listed below and add those that can be considered as achieved already.

PROs and CONs

This method is the easiest one you can use. Nonetheless, it is a very gross estimation of a company’s value and is far from being enough to rise funds.